備案號(hào):遼ICP備19007957號(hào)-1

![]() 聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

Copyright ?2015- 海馬課堂網(wǎng)絡(luò)科技(大連)有限公司辦公地址:遼寧省大連市高新技術(shù)產(chǎn)業(yè)園區(qū)火炬路32A號(hào)創(chuàng)業(yè)大廈A座18層1801室

Revise those highlighted in yellow. Do not need to highlight your revision. Revise the long sentences to short ones.

RESEARCH ON DIVIDEND POLICY IN UK, US, JAPAN AND CHINA

Insert name

Instructor’s name

Course

Institution

Location

Date of submission

Table of contents

Contents

Executive Summary 3

1.0 Introduction 4

1.1 Report outline 4

1.2 Research questions 5

1.3 The research objectives 5

2.0 Literature review 6

2.1 Describing dividend policies 6

2.2 Underlying issues with dividend policies 7

2.2.1 Dividend policies in the developed economies 7

2.2.2 Dividend policies in developing economies 8

2.2.3 Regional differences in dividend policies and corporate governance 9

2.3 Dividend policy signalling, decision making and judgment: client theory 10

2.4 Dividend policies and corporate value 11

3.0 Methodology 14

4.0 Analysis / Discussions 15

4.1 Analysis 15

4.1.1 McDonalds: the United States representation of dividend policies 15

4.1.2 Tesco: a United Kingdom perspective of dividend policies 17

4.1.3 The 21 Lady: the Japanese description of dividend policies 18

4.1.4 China Construction Bank: a Chinese case of dividend policies 19

4.2 Discussion 20

4.2.1 Interpretation of findings 20

4.2.2 Effects of dividend policies on corporate and brand value 22

5.0 Conclusion 23

References 24

Table of figures

Figure 1 Capital structure models influencing dividends and divided policies 8

Figure 2 Trends on GDP and growth of returns 9

Figure 3 MCD dividends 16

Figure 4 21 Lady return, dividend and price 18

Figure 5 CCB dividend histories 19

Figure 6 Dividend statistics 20

In this report, the dividend policy is being described and the choice of companies is also provided for the analysis on dividend policy. With this, this report provides a literature review in which the directions for the report are provided in terms of the suggested empirical findings that dividend policy will be having. Equally, the report provides valuation and comparative descriptive data as suggested and documented in the methodology. Therefore, this report follows the avenues of descriptive data, in analysing the effects of shareholder composition and the corporate value from the dividend policy. Equally, with the sighted references, this report compares its findings on a number of literature text and website documentation from which the findings are related. Therefore, dividend policy is being analysed and provided as the major concern in the management of attitudes for investors and states. In particular, it is noted that dividend policy is a very important dimension in the management of investor composition and corporate values as documented by the adoption of the General Accepted Accounting Principles and the International Financial Reporting Standards.

The main interest that is developed with investments is majorly a concern of returns (Li & Zhao, 2008). Thus, there will be two positions from which investor will be standing at the financial ending of investment periods, this is the suggestions of whether to receive their investment returns or equally reinvest what they have made in the year of operations back to risk gaining more in the next financial year. Looking at this position, the interest that might be existing with the repayment and the reinvestment of the dividend earned will all be dependent on the management that the investment has been receiving. On a personal level, it is, therefore, noted the investment, reinvestment and enjoying return is taken based on the rationality that the investor will be having. In this case, the situation that is presented with the developed and the devolving would will, thus, be familiar on the return on investment as dividend payments (Short, Zhang & Keasey, 2002).

With the interest now highlighted on the issues of dividend payments, this report will, thus, focus on the identification of dividend payment in a more detailed perspective. In essence, the material suggestion defining this term all revolve around the return that the investor and this time they are referred to as shareholders will be getting based on their investment positions in the company of choice (Martins & Novaes, 2012). Thus, the dividends are identified as a return that is only guaranteed with the performance of the company during the financial year. Therefore, with the intention that is identified with the motivation that is validly attached to investor returns, this text seeks to register an analysis on the dividend payment ratios in four different economies of interest. These are the United States, the United Kingdom, the People’s Republic of China, and the nation of Japan. In this measure, the interest develops with the intentions to assess the validity of investing as a shareholder in these four nations. Looking at the observations that are made by Cheng, Ioannou and Serafeim (2014), the nature and the position that is developed with the dividend policy is one that is taken from the general environment that the government regulations will be taking into account.

Therefore, the development that is taken into considerations will be inclusive of the need to examine three directions of dividend policies. First, this report will outline them in its literature review by analysing these policies on dividends, tax and corporate governance that the four economies have (Roberts & Whited 2012). Thus, with this composition of the report, it will focus on the reason behind the difference in these policies within the four countries. Keeping in mind that the United States and the United Kingdom have mature grown up economy, the dividend policy from this direction will be developed from the angles of the developed economy perspective (Mitton, 2004). On the other hand, Japan will equally be one good example of a developed economy except for this report, the economy of Japan will serve to provide an example of the performance of policies within diffract geographical regions. Therefore, on the comparative edge the Republic of China will be taken as the position from which the report will examine the performance of dividend and corporate policies in a developing economy.

From this position, the interest will be developed in the highlighting of the methodology that the report will take the conduct of the research into dividend policy. With a brief interest that this report will seek to provide the direction that it will take in the gathering of information. From this, the report will move to the fourth chapter on which the findings of the analysis will be discussed in very precise details (Fatima & Abdullah, 2014). This analysis will be an equivalent of the finding position that is normally attributed to the majority of the developed research report. Thus, with the interest areas of analysis set the report, therefore, develops the following objectives and research questions for the research.

According to Bryman (2012), the research questions are described to the interest that the inquiry will be having. These are, therefore, described with the inference that normally attaches to the major interest that the report will be serving.

1. What are the differences in the dividend policies within developing and developed economies?

2. Why are there differences in dividend policies within economic regions?

3. How do dividend policies affect the position and the investment affinity of shareholders?

1. To assert that there are differences in dividend policies within different economies.

2. To develop findings on the reasons behind dividend policies.

3. To provide suggestions on the best direction for economies with differentiating and selecting of dividend policies.

In general the interest that is developed with the report outline, the research questions and the research objectives are suggested as the major points of concern from which the management and the policy setting directions of the economy will be interested in manipulating dividend policy to spur economic growth of investment capital (Callao et al., 2011).

This literature review will be developed with the management position that is suggested with a number of written materials. Thus, the assessment of the relevance of the dividend policy is assessed from this direction. This is tabled with the changes that are evidenced by the dividend policies of a variety of companies. Thus, it is noted that a number of companies will not be holding their dividend policies of a constant position (Bryman, 2012). According to Badertscher, Katz and Rego (2013), this is attached to the information that is made available with the interpretation that the investor will be having with this.

Thus, this literature review will choose to describe the dividend policy and equally seek to analyse the underlying issues that are in the markets of investments. This will equally be the position from which the value of the dividend policy will be examined from making the interest of the research questions and a research question from an analytical and descriptive research (Baird, 2014).

According to Aguinis and Glavas (2012), the description of the dividend policies will be described under the suggestion of the dividend policies relating to the distribution of return decisions. In essence, the most attractive thing of an investment portfolio to shareholders will be described as those with a structure direction of the management of returns. Thus, if the mythology from which the return of the company at the end of the year will be described as clarity and precision, the investment gradients seem to get less steep. This is attached to the suggestion that the dividend will be representing the effort made by the company in mining capital gains for their shareholders (Cheng, Ioannou & Serafeim, 2014).

Thus, the dividend policy is equally attached as a position for which the economy and the companies at play within the economy will be willing to pull such that they can attract the share investment into their portfolios. Thus, the interest that is analysed is developed along the suggestions of the competitive edge that the companies in the competitive markets have the acknowledgement of dividend policies. According to Cheng, Ioannou and Serafeim (2014), the performance of the competitive markets, in this case, the nations and the economies of the United States and the United Kingdom. Thus, in the analysis the inquiry will be about whether these nations have a dividend policy which is relevant even with the position that is attached to their competition in the market and the need to remain relevant in the eyes of investors.

On the other hand, the interest that is developed with the management of dividend policy is equally that it can be assessed from the position of shareholders receiving larger dividend payout as divided or equally the opposite (Martins & Novaes, 2012). In fact, Cheng, Ioannou & Serafeim (2014) notes that the majority of the developments that are described in this review will be assessed on the position that the shareholders have with the payments of dividends and the turnover that is exhibited with share sales. Thus, the relevance that is sought out is one that attaches to the need that the company will be having in payment of dividends in markets that is filled with turbulence in market competition and the needs to have their performance described by lucrative nature for investment (Roberts & Whited 2012).

The selection of dividend policy is positioned towards the developments that the company will be having in reference to the interest that this report tabled on the selection of dividend policies of the company. With this, it appears that the underlying issues on dividend policy are revolving on the withholding of dividend payment and the payment ratios that the company will be checking in terms of returns. Thus, it is important to note that the company will need to consider the selection of the dividend policy. This is attached to the facts that dividend policies will most likely be considered in the payment and the selection of the payments. In fact, it is noted that a number of companies will be in a position to regular and equally affect the payment of dividends and most probably get the effects from-gruntling shareholders (Brammer, Jackson & Matten, 2012).

The developed economies, in this case, the United States and the United Kingdom are known to be some of the largest financial markets. With this noted it will be important to assert that the consumers in the divide that is operated by the United States markets and the United Kingdom markets is one that will be assessed based on the developments of the models and the structure that the companies will take in dividend payments. With this, the following models attach to the payments of dividend within the free markets description of the United States and the United Kingdom (refer to Figure 1).

|

Approach in dividend policy |

Main concepts |

Determinants of dividend |

Observation |

|

Behavioral models |

Payment of dividends based on the stability that is attached to target dividends |

Current earnings in the company |

Positive expectation based on pre-determined structure |

|

Dividend signal modeling |

Decisions on dividends payment may be changed by firm management, firm with more information available in the public tend to pay less a valid as more solid role in motivate investors into a future relationship |

Current and future earnings |

Mixed reactions based on the concealing structure as attached to shareholders. |

|

Debt constraints |

Firms decrease or increase payments of dividends based on the debt constraints that they have in the financial year. |

Firm leverage or debt ratio |

Mixed based on the debt performance or the debt ratio in a particular year |

Figure 1 Capital structure models influencing dividends and divided policies

Looking at the development that are suggested by the models above, the directions that are attached to the management of dividend payment in the more developed economies seem to be leveled to the suggestions of having a more flexible position from which the companies will be in a position to evaluate and pay returns. This is a position that is seen as one liberal and bias position from which the company’s management are at the liberty and at the mercy of the performance and of the company management (Baird, 2014).

On the other divide, the description of the management of the dividend policies in the developing economies in these positions is the Republic of China. In essence, according to Cheng, Ioannou and Serafeim (2014), the number of Chinese countries that have been paid out dividends has been overly attached as very small. It is with these descriptions that the concerns of dividend payments are more or less attached as some very new dimensions in this divide. In fact, compared to the United States the performance of the companies in China is because of the difference in corporate governance that is affected by the government shareholding in the Chinese fraternity.

Having noted the difference that is attached to the performance of the companies in China, it is noted that the Chinese companies have been under the effects of a very detailed government influence. Thus, the official statement will be that the companies will not be in a position to describe less in terms of shareholder investments based on the performance of their operation in the year and the government control (Cheng, Ioannou & Serafeim, 2014). As a result, looking at the position that is suggested with the dividend policies in the developing and the less liberal markets in China, the interest that is developed is one that is seemingly on that attributes government control and private investment do not go hand in hand.

On the other extreme divide, the performance of corporate governance is one that is tabled along the suggestions of the performance of the company in terms of the geographical differences. In essence, looking at the expression that is attached to the investment in Japan, a number of concerns come out in the open. These are attached to the moves that the Japanese companies have been showing in the recent future (Bryman, 2012). In fact, more of Japanese companies are seemingly describing more values in the budgets and the expenses that they give to the corporate governance. With this in mind, the moves that are exhibited with the performance of the companies in Japan are seemingly best attached to the investment creativeness that this corporate governance offers. According to John (2015), the performance of the ‘show me the money’ corporate governance by the Japanese government, there has been a number of changes that have actually warranted the need to have them change their productivity to their growth in capital markets (Martins & Novaes, 2012). According to the extract on the figure from the Japanese minority of finance, the nation is on the verge and the path of structural profitability that has been increased with globalization.

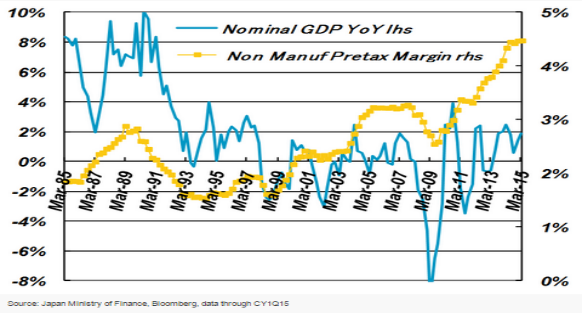

Figure 2 Trends on GDP and growth of returns

The yellow index describes that pretext margin that was attributed to the non-manufacturing companies. In this valuation, the description that is, therefore, attached to the performance of the companies in Japan is equally the one that is attached to the eventuality of a rise even with the nominal GDP rising (John, 2015).

With the interest that has been developed in the above agreements for the developing nations and the dividend policies, it will be important to format an assessment based on the signal, decision-making and the judgement that comes with dividend policies (Strebulaev & Whited, 2013). First, according to Li and Zhao (2008), the most valid position from which the dividend policies are sought after will be having in mind that the returns to investments as mentioned earlier. Mathematical finance tables this as the entry point from which the computation of the cost of equity and the dividend growths are monitored. Therefore, the position of the client theory is also directed towards the valuation of the position that is held with the clients as investors and shareholders (Short, Zhang & Keasey, 2002).

Thus, according to the client theory the main idea is that with the changing of the dividend policy the firm is most probably open to the loss of a number of clients. Looking at the marketing description of clients, the basic identification is maintained alongside the fact that the clients or the customers in the business are identified as stakeholders. This makes the company’s management and in particular, the regulators of the economy at a very particular position about five distinct characteristics on the setting of dividend policies (Li & Zhao, 2008). The first one of the theories consideration is based on the need to ensure that with dividend setting the companies will be in line with the recommendation of the avoidance of cutting into the net present valuation of the project that are in continuation. This implies that in the calculations and the administration of dividends and that of returns that are attributed to the future valuations need to be kept aside. Secondly, the theory maintains an avoidance of the dividend cuts, the need to secure equity to the shareholder equally being a very primary concern. Finally, the client’s theory on dividend policy is primarily attached to the needs to maintain the healthiest of debt ratio as well as maintain and set out the dividend payment ratio (Martins & Novaes, 2012).

Therefore, according to the suggestion of the client theory, it seems to be attached to the needs that the company will be having in ensuring that they have a well-defined and a well-structured dividend payment ratio (Short, Zhang & Keasey, 2002).

The client effect theory is, therefore, based on the above suggestion, the mechanism to which the theory has been attached to the payment and the recognition of dividends has been provided. In this position, the effects of the client theory describe that the investors will only be willing to have their intentions matched to the investments that the firms will be making. In this Bena and Li (2014) argues that the investors in the client theory effect will be seeking for a position under which their factor endowments are favourable. These are arguably the common description of the investor making ratio investment decisions with the tax implication of investment returns in mind. This will be true to assert that the relation between the stock returns which are the dividends and the tax levels is an increase one (Badertscher, Katz & Rego, 2013).

With this, investors in the higher tax brackets will seemingly prefer to invest in low-return investments such that they are tangibly liable for less tax. On the other hand, investors or shareholders in the lower tax bracket will equally choose the stock with higher dividends because they are oblivious about the tax implication based on their current affinity to lower taxes (Badertscher, Katz & Rego, 2013). This is an assumption that is equally attached to the lifestyle and the age groups that people have. The majority of the working class will hold stocks with fewer dividends based on the lower returns and the retired population seemingly constituting the higher percentage of the high return dividends in the United States and the United Kingdom currently.

Therefore, looking at the dividend policy and the structure that are suggested by the client effect theory, it will equally be very material to assess the degree and the truth of this in the United Kingdom, the United States, Japan and equally the developing economy of China. Looking at the global index on the annual dividend growths, the following transpires making this literature review develops more findings on the position of the client theory in this case. In fact, focusing on the United States as tabled with the morning standard index, the growth of portfolio seems to be stagnating to a normal after the 2007-2008 financial crises (Callao et al., 2011). On the other hand, the majority of the companies in the People’s Republic of China have been reporting a good description of portfolio growth as will be seen in the data discussion and analysis. Nevertheless, looking at the position that is described with the shareholders from China, the description is completely different from what is expected from the position of the Japanese, United Kingdom, and the United States.

Thus, with the suggestions that had been poised with the five pillars of setting the client theory and any other dividend theory, therefore, review notes that with the mindset of the clients set on identifying return with the tax liability (Badertscher, Katz & Rego, 2013). They are bound to be the very different direction of dividend policies and investment patent in the different states with different tax laws.

The majority of discussions will be primarily focused on this subheading of literature analysis. According to Chemmanur, Loutskina and Tian (2014), the corporate value of the company is what the majority of companies attach as the intangible asset position in brand value according to IFRS 3 and the goodwill equally recognizes by the regulatory framework of accounting under the IFRS 138. With this, the interest that is normally sought after is one that based on the position of a business combination (Taylor & Richardson, 2012). It will be true to assert that it is during the position that is played with the valuation is materially developed in the needs of asserting the corporate value of the company. Therefore, the corporate value is one thing that can be enhanced on the dimensions of giving the company better brand identity even with their investors. With this in mind, the question that is posed by dividend policies is, therefore, one that can equally be answered based on the needs of corporate awareness and corporate value creation.

According to Mitton (2004), the description of the corporate valuation in the United States and the United Kingdom will be materially very different from those in Asia. In the management of the free trade policies, the market of China is the one that still mainly has a number of restrictions on the management and the regulation of trade. This implies that the state control is huge in a number of the industries. In fact, based on the argument that is fronted by Taylor and Richardson (2012), the control of industries, sectors and even companies by the government is highly limited to the performance of the corporate sector. According to the argument fronted by the field of economics, this is suggested alongside the management of the brand valuation in identifying creation.

This is to link the policy effect of the dividend policy to the corporate valuation, a number of positions are noted, and these are the internal operations that guide the business a way of conduct (Aguinis & Glavas, 2012). There will equally be very important to identify with the position that is attached to the needs that the companies will be having with the identification and the recognition of the dividend policy.

Thus, with the link that has been identified in corporate value entailing the constant position that the benefits of the dividend policy to the corporate value is established. The dividend policy will be among the major concern that a company will be fronting is its brand value and the corporate identity is to sell to the shareholders. This is described along the suggestions of the dividend policy providing the shareholders with the valid position from which they will be able to assert their investment validity. Thus, according to Mitton (2004), the position from which the corporate value is influenced by the dividend policy will be positioned to the operating philosophies, and the relationships that the company have. Specifically with a very particular mission statement the organization can be positioned to the management of the maintaining of core values and share in investor management. This implies that the dividend policy can be used to fully attach and attract the investor that they will need. From this, this text will equally borrow from the suggestions that had been levelled with the intentions of the earlier literature sighting the effects that are attached to the client theory (Bena & Li, 2014).

The client theory suggested that the investors are different and have some affinity to the tax implication on returns and dividends. Thus, looking at the position that is suggested with the dividend policy, the investor will be able to know whether the returns of the company are either high or low. This will equally be a position from which the assessment of the investment can be attached to the descriptions of the need and apathy to identify with the positions of the attracting of investors. Thus, other than the attached position that is attached to the description of the analysis in the good that the dividend policies have on the corporate value. It will equally be important to focus on the suggestions that are attached to the maintenance of the dividend policies as having effects on the firm value (Martins & Novaes, 2012). In essence, according to Roberts and Whited (2012), brand value is attached as the relevance that the dividend valuation and the dividend policies have on the corporate value of the company. The position that is entirely supported by the management of the dividend is, therefore, levelled to a number of models that have been presented for the creation and the assertion of the relevance of dividends (Da, Guo & Jagannathan, 2012). One of these is the Walters model, which fully attaches the inquiry on relevance to the value of the share on which the investors are earning the dividends. Arguably, some of the most prolific arguments have been tabled with the ideas of the lower values of shares need not to be paying dividends. This is because only those who hold bulk shares are in any benefit from their investments. Equally, the major assumptions that materialize here are those of the retained earnings, the cost of capital and identified with the CAPM model and the brand life as endless (Da, Guo & Jagannathan, 2012). With the position that this assertion has as misleading, their main concern has equally been identified as one position from which the company and the corporate value of the brand can be accessed.

Therefore, with the literature review focusing on the assessment and the theories that are attached to the management and the functioning of the dividends theory, it will be true to assert that the identification and the assumption of the perpetual aspect for life for the company is one thing that corporate brand can use in enticing their investors. Such is made along the various directions of the dividend policies (Mitton, 2004). In essence, the dividend policies have been described as inclusive of the ideas that are attached to the management of the dividend policies in this dissertation presentation. Equally, looking at the suggestions that have been attached by the underlying issues on dividend policies, this literature review has assessed the position that is attached to dividend policies based on the need to have a gain and a positive description on the corporate value. In essence, the next chapter presents the methodology under which the analysis will be focusing on suggestions the collection of data and collection of information on dividend policies and corporate value (Bena & Li, 2014).

The methodology will primarily seek to further the analysis that has been presented by the literature review. This is practically based on the suggestions of the use of secondary research owing to the nature of the research objectives, the scope, and the research questions. Therefore, with the objective and the questions identified earlier in the introduction, the scope will be suggestive to cover the dividend policies in the four countries. This is, therefore, going to be the corporate analysis of the dividend policies as advanced with a number of companies in the United States, United Kingdom, Japan and China. In essence, these companies are the Tesco group of retail supermarkets in the United Kingdom, the McDonalds chain restaurants in the United States, the 21 Lady Company Limited in Japan and the China Construction Bank. The choices have been selected from seemingly different sectors of retail position except for the China Construction Bank as the McDonalds will be taken as representative of the performance of the public retailers in the Chinese economy.

Therefore, the management of this methodology will seek to develop an analysis on the position of the portfolio growths of the four companies as suggested by their annual reporting. This will equally be the position from which the growth in the cost of equity will be assessed, the growth in dividends will be assessed, and equally the position from which the value created with the paid dividend will be documented.

Other than the tabling of the performance of the companies and the subsequent payment of dividends, this methodology will seek to explore the use of the categorical data in the analysis. This is attached to the suggestions of the friendliness of dividend policies to investors’ confidence among companies and equally the environment that regulates the use and the formulation of the dividend policies.

In essence, this methodology will be more like a descriptive analysis solves the major concern raised by the research questions and the research objectives which are levelled with the identification of the differences and dividend policies among these developing and developed nations (Bryman, 2012).

With the interest that the methodology has fronted the performance of the analysis is documented based on the position that is held with the four countries. Equally, it is considerate of the four companies chosen as representatives to their interest on dividend policies and corporate management in these countries. Previous research similar to those used in the literature review took the analysis of the dividend policies in two criterions. First were the comparisons of published earnings and the dividend payouts on the reflection of company performance. This comparative measure on dividend policies was seen as a biased, this is based on the direct inference to relevance of using these policies. Second were the studies on the determinants of dividends from which Mitton (2004) argues on the function Du = rtEt, this is the target of firms which reflects the dividend policies and the target ration in the years compared to the actual profits and dividend received. Thus, this second approach is more interested in the reasons for making adjustments rather than focusing on the direct effects and needs of the dividend policies (Michaely & Roberts, 2012; Rees & Valentincic, 2013).

Developing from this angle, the following are the dividend policy analyses of the McDonalds restaurant, the Tesco supermarket, the 21 Lady Company Limited which is a retailer and the China Construction Bank. In this chapter, the interest will be functionally developed into the examination of the dividend policies that the companies have been having in the last two to three years. Thereafter the chapter will be presenting a discussion on a comparative measure of the dividend policies and the effects that have on the shareholder investment valuations, the growth of the capital equity that the companies have and equally the corporate value of the four brands (Wang, Manry & Wandler, 2011).

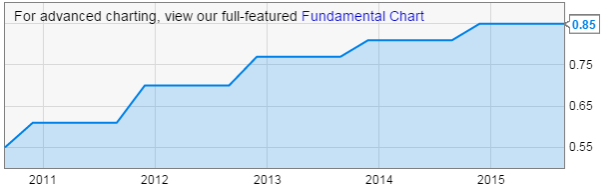

The description of the McDonalds provides some very concrete descriptions of the position that can be held by the American divide on the payment of dividends. In essence, the first time that the company was listed in the stock exchange market was in the year 1976 (Ycharts, 2014). It is impressive enough that the McDonalds also managed to pay its first dividends in the same year. More of this impressive record is that the company has been in the position of growing their dividend payments all along with their latest run from the year 2008 to 2014 recording the highest position of dividend growth on an annual base. In fact, they have been on the record of paying dividends at every quarter of operation with the latest being a $0.85 per share payable on the 16th of September 2015 (MCD, 2014).

In the attached figure, the growth of the dividends for the McDonalds brand can be evidently seen as valid to the earlier stated discussions. Equally, this information can be better classified with the presentation held by (Ycharts, 2014). With this in mind, it will now be important to analyse the annual report and to document the validity and the existence of the policies on the payments and the management of dividends. According to item 5 of the related shareholders matters the company has a very well structured dividend policy (MCD, 2014). With this, they provide information of the trading position of the company in the New York stock exchange as well a fully summary of the performance of their last financial year compared to the previous financial year. Thus, the dividend policy in the McDonalds Company seems like one that is positioned at the examination of the returns that the shareholders are givens based on the identification of the shareholder composition in terms of their numbers. This dividend policy equally states the record that the company has had in their 39-year history of payment. Arguably, Harris (2013) supports the position that is asserted with this move by the McDonalds Company. In essence, this supporting argument is based on the facts that the presentation of such information and with openness and clarity of information, it will be a position from which investor confidence is built from (Erkens, Hung & Matos, 2012). Nevertheless, it will also be important to note that the McDonalds financial reporting is based on the General Accepted Accounting Principles (GAAP) rather than the conventional International Financial Accounting Standards (IFRS) (Harris, 2013). With this, it is noted that the company is not compelled to the highlighting of the methodology from which the dividend payments are computed from. The simple presentation of dividend information is attached as the full and acceptable representation of the dividend policy that the companies in the United States will be having. On the other divide, it is noted from the annual report of MCD (2014) that the company has more than the shareholders’ investments in their equity composition. The position of material contracts is one that will be in need of further clarification to be considered as a dividend or a shareholding policy document. This brings the analysis to the assumptions that the developed nations and, in particular, the United States are seemingly not very open with their investment policies to their shareholders. Simple documentation based on the records of the financial performance of stock items cannot be assumed to be effective in swaying the opinion of shareholders, and corporate value on brand valuation as held by the IFRS 3 (Carmona & Trombetta, 2012; Ramanna, 2013).

The performance of the United Kingdom as an investment ground can be better established with an examination of their largest consumer markets. According to some of the data that is represented in Tesco Investor Policy (2006), the retail consumer market in the United Kingdom is equally the one that achieves such large magnitudes. The Tesco brand is, therefore, one of the major players in the United Kingdom’s retail consumer market. This is because of the dominance in the retail supermarkets and equally the position that they hold with their financial services pouring into the banking industry (Tesco Plc., 2014). Thus, looking at their divided history, the Tesco brand envelops the performance of the United Kingdom as one that is linked to the concerns of the IFRS. With this, the interest is that the company will need to keep a pathway in which they will be in a position to examine the payments of divided based on the laid guidelines. Looking at the Tesco Investor Policy (2006), in the year 2006, the Tesco brand is said to have been announcing a new dividend policy that is supposedly in existence up to now. This is in order to increase the dividend payouts broadly in line with its earnings growth rate (Tesco Plc., 2014). With this, the position that is described with the Tesco brand is one that would be appealing to the majority of shareholders and investment funds. Similar to the record that the American counterparty McDonalds is proud of, the Tesco brand has been in the last 20 year paying solid dividends based on their financial performance in these years. Looking at their performance as present in Tesco Plc. (2014), one will note that there are variations to the dividends that are paid all through the year quarterly results and, in particular, the overall year descriptions.

The description that is provided by the Tesco brand in their company profile equally suggests that the company is the one that asserts their performance and the moves with regards to the issues and the payments of dividends as matching to those of the regulators in the London stock exchange (Tesco Investor Policy, 2006). With this they have provided for their shareholders the option of the dividend reinvestment plan, fully payout or equally having them directly as savings for retirements. Exploring more on brand valuation, the performance of the Tesco brand in terms of their dividend payment and their dividend policy will be described as better behaviour with the affinity that is attached to the well being of the shareholders (Goldstein & Hackbarth, 2014).

In particular to the annual report of last financial years, the Tesco brand pays a full dividend of 14.76 p on which the group maintains that it has a good run with the return on capital documented at 12.1%. With this in mind, the notes to the financial statements equally describe the dividend policy that the company used in the year 2014. In Tesco Plc. (2014) the extract on the principal risks and the uncertainties describe the group strategy to investment and the group position in management and equally brings down the same emphasis on the company disclosure policy. Looking at these suggestions it will be true to consider that the United Kingdom representation has equally been seen as one company that has strived to disclose more on their performance and their use of the dividend policies. With this, this report assumes that to the interpretation of the IFRS in the United Kingdom, the simple description of policy statement will be enough for the interest sought after by dividend policies (Borker, 2012; Martins & Novaes, 2012). Nevertheless, the irregular pattern that seems with their description of dividend can equally be a position from which the effectiveness of their policy most precisely from 2006 can be examined and equally excused as functional.

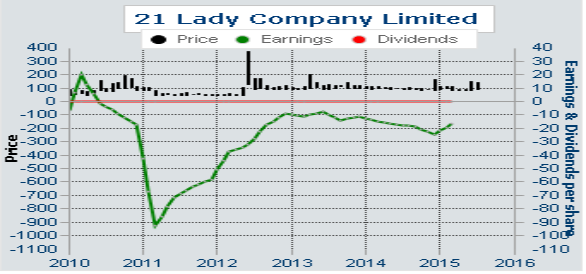

In nature, the attachment that is seen with the western side of dividend policy is very different to the interest that is served with the Japanese description on dividend payouts. The company operates a number of retail bakeries in the Japanese divide (21 Lady Company, 2015). Looking at their financial performance, a number of things are noted with the financial profitability of the company and the dividend payouts that are recorded from the year 2010 to 2014. The dividend payouts are flat withstanding the facts that the earnings of the company have been dropping. In fact, the dividend payouts during these four years have been described as zero per share as attached in the figure below (Gurufocus, 2014).

Figure 4 21 Lady return, dividend and price

With the Japan being one of the most liberally developed nations in the pacific region, their dividend policies seem to be tagged to the contents of the business and natural environments other than the financial performance. One would seemingly be expected the value of the share of the company to be dropped with the financial performance that the company may be posted in the financial years. As developed from the reporting that is staged with the 21 Lady Company, the direction of their dividend policies is attached as follow: the dividend payments of the company are based on the financial performance that it stages in the financial year. Nevertheless, they still maintain that the dividend payments will, however, be influenced also by a number of considerations. These are the environmental analyses that the company will be having in their industry and equally the dividend to equity ratio (21 Lady Company, 2015). In essence, the payments of dividend, therefore, appeal to the direction that is not very open to the shareholders in Japan. This is because even with a good financial performance, the gains that the shareholder might be making will materially be brought to a re-assessment and a re-evaluation based on the business environment and the dividend to equity ratio which this report assumes is to set the standard in the Japanese trading of equities.

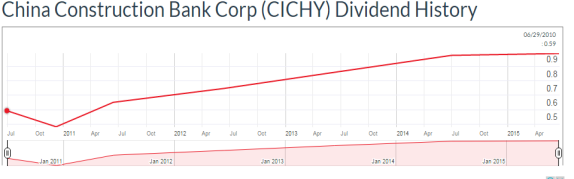

The Chinese Construction Bank is constituted of capital and equity composition, and it is one of the largest commercial banks among the Asian nations. In the mean time, it is one of the leading financial institutions in the Asian market (Chemmanur, Loutskina & Tian, 2014). Looking at their corporate profile, it is noted that the company treats its stakeholders very seriously. The dedication is the evidence from the investor profile that the company maintains. The China Construction Bank can seemingly be excused to be the best example of the four examining domains and it will be tabled in the discussion. This is materially based on the very good and considerable growth rates that the company has provided with their dividend growths in the last four financial years. The growths in dividends have been materially from the low point on the first half of the 2011 financial year to the almost flat position that the dividend growth attained at the beginning of the financial year 2015-2016, as attached to the figure below (CCB: Corporate Profile, 2015).

Figure 5 CCB dividend histories

Looking at this historical valuation, the position that is described now will need to fully analysis the management position to the payments of the dividends according to Short, Zhang and Keasey (2002). With a similar position to the description of free trade and disclosure of information, China seems to be on the upper hand even with the treatment of their operations with general regard for communism. Nevertheless, the position that is asserted with the overall performance of the company can be taken from their annual report (China Construction Bank, 2014). This is because rather than the normalcy that has been seen in summarizing the dividend policies, as well as skimpily providing for the methodology under which the dividends were valued. The performance of the company in managing ethics seems to be the only one that is fully catching up with the IFRS regulations on financial reporting. The profit and dividend chapter are provided such that the investor will be in a position to weigh for themselves the ratio and the percentage of profit that will be dedicated to the dividends.

Equally, the chapter has an extract on the formulation and the implementation of the cash dividend policy. With this, the China Construction Bank has their policy statement of “the bank shall distribute dividends in cash if its profits in the year are recorded and if it has a positive accumulation on undistributed profits” (China Construction Bank, 2014, p. 97). According to Gebhardt and Novotny-Farkas (2011), there are a number of positions that can be extracted for such a policy statement. With this, one will note that the China Construction Bank only pays the dividends in the case that it has recorded profits, equally the dividend payouts are only made in cash if the undistributed costs are positive. This implies that the company might be in a position to pay dividends by using other options such as share splits or bonus of the undistributed profits for the years when the profits are negative. In particular, the formulation and the implementation of cash dividend policy that the China Construction Bank has provided to go ahead to describe and quantify the undistributed profits of the company. This is described as the fact that the company will only be in the position to distribute the cash dividends if the undistributed profits are not less than 10% of the net profits.

One will seemingly note that the computation and the final declaration of dividends in the Chinese decryptions seen to be very much attached to the procedure. In majority of the state-controlled companies as suggested by Cheng, Ioannou & Serafeim (2014), the payments of dividends are equally affected by the shareholding capacity that the state will be having in these companies. Thus, the higher the state control and influence, the lower the dividend payouts. Hence, there is seemingly a negative association between the length of control chain and the dividends that are given by the Chinese companies (Martins & Novaes, 2012). With this in mind, it will equally be very impotent to assess the shareholder composition of the China Construction Bank. According to Borker (2012), this is described as a control that is at 9%, perhaps this is the reality with the positive position that the bank has been having with their undistributed profits over the years.

Looking at the interest that has been served by the descriptive analysis of the financial statement as presented in the annual report for the four companies, a difference is seemingly noted in the position that the regulatory framework has been used in financial reporting (Callao et al., 2011).

|

Company |

2010 |

2011 |

2012 |

2013 |

2014 |

|

MCD |

1.65 $ |

1.83 $ |

2.1 $ |

2.34 $ |

2.47 $ |

|

Tesco |

4.37 GBP |

14.64 GBP |

14.97 GBP |

14.97 GBP |

12.29 GBP |

|

CCB |

0.24 ¥ |

0.18 ¥ |

0.17 ¥ |

0.18 ¥ |

0.4 ¥ |

|

21 Lady |

0 |

0 |

0 |

0 |

0 |

Looking at the description of the most successful economy in the world, the McDonalds’ description of the United States seems very unattractive to the interest that the shareholders will be having. This is based on the lack of a formidable dividend policy as described in the regulation of the GAAP (Harris, 2013). On the other hand, the description that has been presented by the Tesco brand signals a very different and a more ample procedure into the declaration of dividends. The dividend policy stipulates the payments of dividends based on the position that the company will be having in their profits. It will be important to note that the United Kingdom seemingly attaches dividend payments to the position that is asserted with their profitability (Li & Zhao, 2008).

Moving this interpretation to the Asian side of the analysis, the two countries represented, in this case, are Japan and the People’s Republic of China. With these two nations, there has been some differences that have been noted are, in the maintenance of the investment and the formulation of dividend policies, it has been noted that the two countries are seemingly attached to policies, but the position of China is more detailed in terms of the IFRS satisfactions (Gebhardt & Novotny-Farkas, 2011). Thus, the development of the dividend policies in the China Construction Bank brings to light the reason why the company will be providing anything else to their shareholders other than the dividend payments in terms of cash payments. With this, this report is about the idea that the China has a better position because of the recognition of dividend policies. Equally fronting from the position that was developed earlier in the introduction, the choice of China is taken as one of the economies which is on the move and labelled as developing. Thus, in the developing nations, the stability that is sort after in the management of dividend policies seems to be better placed compared to economies which already have this as a fact (Badertscher, Katz & Rego, 2013). Thus, it is noted that the company has no regulations on the choice of dividend payment. Nevertheless, a look at Japan and China reveals that the Asian description of dividend policies is more attached to a number of bottlenecks. This brings to light the limitation of shareholders’ freedom which is practically attached to the United Kingdom valuation on shareholders and dividend policies. In essence, this is the position that the analysis will prefer an investment made in the United Kingdom compared to the economies of the United States, Japan and China. Individually, the United States falls out of the interest of this report based on the interest that the GAAP has some material differences in recommendations for financial reporting as provided by the 10-K annual report for the McDonalds Company (Harris, 2013).

In the second description of Japan, the 21 Lady Company Limited is noted to have a flat yield curve even with the situation where share value and revenue value were growing. This is based on the fact that the dividend payments are not materially based on the valuation of the company financial performance; however, dividend valuation is also provided for the interest of environmental factor in the course of the financial year. Lastly, even with China posting the best of disclosure of information, the interest of this report comes to the conclusion of fear. This is because the state has controlled the level and the payment of dividends. Equally, dividends been paid are not based on the net profits of the company, but on the profits to which the company calls undistributed profits. Another limitation is that the undistributed profits equally need to be figured at a 10% or more valuation for the shareholders to get any dividends. This dividend policy is tighter but clear in execution (Martins & Novaes, 2012).

Looking at the position that has been described with the four valuations of the descriptive analyses above, the methodology was seeking to highlight the research objectives on existence and reasons behind the differences in dividend policies. This has been satisfied, the research questions are answered as follows. The effects of dividend policies are mainly attached to the shareholders’ affinity to investments. This is material to the position that is described in the shareholders needing an assurance when it comes to dividend growth. In this sense, looking at the information held in the Ycharts (2014), the payment of dividends by the McDonalds Company seems static, and information to shareholders can very well interpret this as a direction that the company has the restricted position in dividend payments (Li & Zhao, 2008). This is to imply that the dividend payments are the grounds from which China and the United Kingdom seemingly want to maintain good investment relationships with their shareholders. Nevertheless, the assumption that is in this report will equally be guided by the government control in China. It is noted that this is affected based on the high debt levels that the state control has. This, therefore, implies that the state will be willing to hold profitabilities in order to offset their debts.

The development of this report was conclusively presented with the interest of assessing the dividend policies in the global markets. Thus, based on the outline that was presented in the introduction, this report served to fully follow the mandate based on the presented literature review. A description of the methodology was used and the presentation of the analysis was based on the descriptive data that the methodology presented. With this, the literature review sought to describe the dividend policies based on the underlying issues that are attached to the dividend policies in the different regions. It has been noted that the different geographical and economic regions have very different sets of operations in the maintenance of the dividend policies. This has been equally a position that was materially examined by using the development that was staged in the analysis segment of this report. In essence, the signalling effect, the decision-making direction and the profit sharing motive of dividend policies have equally been examined as suggested by the last sub-chapter of the literature review.

With this interest that has been developed equally in the descriptive data analyses, it has been noted with the special interest that there are no regulations from the global regulatory accounting standards. This is on the measures that can be used in declaring and the exercising of payments for dividends. This has been noted as a move that is coming from the deviation of the different policies in companies as implemented in Japan, the United Kingdom and the Republic of China, which all use the IFRS. With this position in mind, it is true to assert that the answers to the research questions are all position.

Therefore, for companies in China, the government can be the influencing factor in maintaining their interest on dividends policies. Equally, the position that the investors and the shareholders have in this case is very dormant. This is because the dividend policies that a company will use are only developed and determined by the company itself without and prior of the future consultations (Cheng, Ioannou & Serafeim, 2014). Thus, to have a better position in attracting shareholding capital, the dividend policies need to be structured in a way that they will signal shareholder value and attention. Equally, ample and steadfast decision making has been noted as effective on judgments as suggested using the client theory in the literature review. As a result, dividend policies are, therefore, asserted as a position from which influence in shareholder investment can be sought after (Li & Zhao, 2008).

21 Lady Company (2015) Annual report, dividends payout, accessed 21 July 2015, HYPERLINK "http://performance.morningstar.com/stock/performance-return.action?p=dividend_split_page&t=3346®ion=jpn&culture=en-US" http://performance.morningstar.com/stock/performance-return.action?p=dividend_split_page&t=3346®ion=jpn&culture=en-US

Aguinis, H. & Glavas, A. (2012) 'What we know and don’t know about corporate social responsibility a review and research agenda', Journal of management, vol 38, no. 4, pp. 932-940.

Badertscher, B.A., Katz, S.P. & Rego, S.O. (2013) ' The separation of ownership and control and corporate tax avoidance', Journal of Accounting and Economics, vol 56, no. 2, pp. 228-250.

Baird, L.L. (2014) Using research and theoretical models of graduate student progress, Jossey-Bass Publishers, San Fransisco.

Bena, J. & Li, K. (2014) 'Corporate innovations and mergers and acquisitions', The Journal of Finance, vol 69, no. 5, pp. 1923-1960.

Bloomberg (2015) Tesco Plc , accessed 03 July 2015, HYPERLINK "http://www.bloomberg.com/research/stocks/financials/financials.asp?ticker=TSCO:LN" http://www.bloomberg.com/research/stocks/financials/financials.asp?ticker=TSCO:LN

Borker, D.R. (2012) 'Accounting, culture, and emerging economies: IFRS in the BRIC countries', Accounting, culture, and emerging economies: IFRS in the BRIC countries, vol 10, no. 5, pp. 313-324.

Brammer, S., Jackson, G. & Matten, D. (2012) 'Corporate social responsibility and institutional theory: New perspectives on private governance', Socio-Economic Review, vol 10, no. 1, pp. 3-28.

Bryman, A. (2012) Social research methods, Oxford University press, London.

Callao, S., Ferrer, C., Jarne, J.I. & Lainez, J.A. (2011) 'The impact of IFRS on the European Union: Is it related to the accounting tradition of the countries', Journal of Applied Accounting Research, vol 10, no. 1, pp. 33-35.

Carmona, S. & Trombetta, M. (2012) 'On the global acceptance of IAS/IFRS accounting standards: The logic and implications of the principles-based system', Journal of Accounting and Public Policy, vol 27, no. 6, pp. 455-461.

CCB: Corporate Profile (2015) New Investor, accessed 21 July 2015, HYPERLINK "http://www.ccb.com/en/newinvestor/ddividend.html" http://www.ccb.com/en/newinvestor/ddividend.html

Chemmanur, T.J., Loutskina, E. & Tian, X. (2014) 'Corporate venture capital, value creation, and innovation', Review of Financial Studies, vol 27, no. 8, pp. 2434-2473.

Cheng, B., Ioannou, I. & Serafeim, G. (2014) 'Corporate social responsibility and access to finance', Strategic Management Journal, vol 35, no. 1, pp. 1-23.

China Construction Bank (2014) Annual report, accessed 21 July 2015, HYPERLINK "http://www.ccb.com/en/newinvestor/upload/20150429_1430311957/20150429203640060598.pdf" http://www.ccb.com/en/newinvestor/upload/20150429_1430311957/20150429203640060598.pdf

Da, Z., Guo, R.J. & Jagannathan, R. (2012) 'CAPM for estimating the cost of equity capital: Interpreting the empirical evidence', Journal of Financial Economics, vol 103, no. 1, pp. 204-220.

Erkens, D.H., Hung, M. & Matos, P. (2012) 'Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide', Journal of Corporate Finance, vol 18, no. 2, pp. 389-411.

Fatima, A.H. & Abdullah, A.M. (2014) ''Firms’ Financial And Corporate Governance Characteristics Association With Earning Management Practices: A Meta-Analysis Approach', Journal Of Economics And Business, vol 12, no. 2, pp. 49-74.

Gebhardt, G. & Novotny-Farkas, Z. (2011) ' Mandatory IFRS adoption and accounting quality of European banks', Journal of Business Finance & Accounting, vol 38, no. 3-4, pp. 289-333.

Goldstein, I. & Hackbarth, D. (2014) 'Corporate finance theory: Introduction to special issue', Journal of Corporate Finance, vol 29, no. 1, pp. 535-541.

Gurufocus (2014) 21 Lady Financials, accessed 21 July 2015, HYPERLINK "http://www.gurufocus.com/financials/NGO:3346" http://www.gurufocus.com/financials/NGO:3346

Harris, P.A.L.W. (2013) 'US GAAP Conversion To IFRS: A Case Study Of The Balance Sheet', Journal of Business Case Studies (JBCS), vol 9, no. 2, pp. 133-140.

John, V. (2015) Japan's “Show Me the Money” Corporate Governance - June 2015, accessed 13 July 2015, HYPERLINK "http://en.nikkoam.com/articles/2015/06/japans-show-me-the-money-corporate-governance-june-2015" http://en.nikkoam.com/articles/2015/06/japans-show-me-the-money-corporate-governance-june-2015

Li, K. & Zhao, X. (2008) 'Asymmetric Information and Dividend Policy', Financial Management, vol 37, no. 4, pp. 673-694.

Martins, T.C. & Novaes, W. (2012) 'Mandatory dividend rules: Do they make it harder for firms to invest?', Journal of Corporate Finance, vol 18, no. 4, pp. 953-967.

MCD (2014) Investor Stock, accessed 21 July 2015, http://www.aboutMcDonalds.com/mcd/investors/stock_information/dividends.html

Michaely, R. & Roberts, M.R. (2012) 'Corporate dividend policies: Lessons from private firms. Review of Financial Studies', Review of Financial Studies, vol 25, no. 3, pp. 711-746.

Mitton, T. (2004) 'Corporate governance and dividend policy in merging markets', Emerging Markets Review, vol 5, no. 4, pp. 409-426.

Ramanna, K. (2013) 'A framework for research on corporate accountability reporting', Accounting Horizons, vol 27, no. 2, pp. 409-432.

Rees, W. & Valentincic, A. (2013) 'Dividend irrelevance and accounting models of value', Journal of Business Finance & Accounting, vol 40, no. 5-6, pp. 646-672.

Roberts, M.R. & Whited, T.M. (2012) 'Endogeneity in empirical corporate finance', SSRN, vol 1, no. 1, pp. 1-9.

Short, H., Zhang, H. & Keasey, K. (2002) 'The link between dividend policy and institutional ownership', Journal of Corporate Finance, vol 8, no. 2, pp. 105-122.

Strebulaev, I.A. & Whited, T.M. (2013) 'Dynamic corporate finance is useful: A comment on Welch', SSRN, vol 2, no. 4, pp. 12-29.

Taylor, G. & Richardson, G. (2012) 'International corporate tax avoidance practices: evidence from Australian firms', The International Journal of Accounting, vol 47, no. 4, pp. 469-496.

Tesco Investor Policy (2006) Announcement of new dividend policy, accessed 21 July 2015, HYPERLINK "http://www.early-retirement-investor.com/-announcement-of-new-dividend-policy-.html" http://www.early-retirement-investor.com/-announcement-of-new-dividend-policy-.html

Tesco Plc. (2014) Shareholders, accessed 03 July 2015, HYPERLINK "http://www.tescoplc.com/index.asp?pageid=43" http://www.tescoplc.com/index.asp?pageid=43

Wang, X., Manry, D. & Wandler, S. (2011) 'Stock Dividend Policy in China', Journal of Global Business Management, vol 7, no. 2, p. 1.

Ycharts (2014) MCD Dividends, accessed 21 July 2015, HYPERLINK "http://ycharts.com/companies/MCD/dividend" http://ycharts.com/companies/MCD/dividend

24h在線客服

24h在線客服

備案號(hào):遼ICP備19007957號(hào)-1

![]() 聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

Copyright ?2015- 海馬課堂網(wǎng)絡(luò)科技(大連)有限公司辦公地址:遼寧省大連市高新技術(shù)產(chǎn)業(yè)園區(qū)火炬路32A號(hào)創(chuàng)業(yè)大廈A座18層1801室

499元

一節(jié)課

咨詢電話

咨詢電話:

186-0428-2029

在線咨詢

微信客服

微信咨詢

回到頂部

hmkt088